ADDITIONAL RESOURCES

Recommended resources on gender diversity:

Hong Kong’s resources

1. Stock Exchange of Hong Kong Limited (the “Exchange”) Resources

Diversity is a key component of business success and we are proud to champion it across our markets, business and communities.

Browse our Board Diversity Hub for a range of resources from HKEX. We hope these resources will help individuals, issuers and all other interested parties learn more about diversity and inclusion, affect change, and create a more inclusive future.

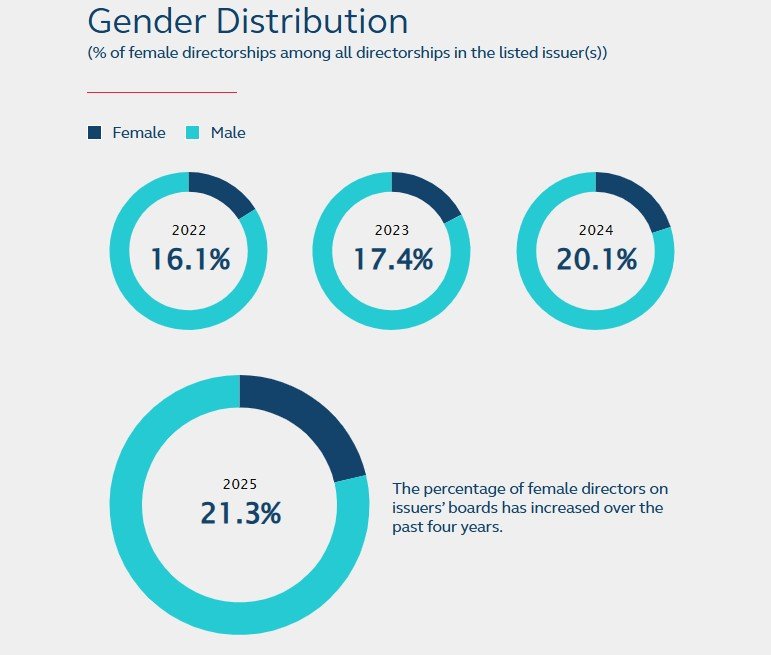

The HKEX Board Diversity Hub included the best statistics source for Hong Kong boards.

Investors should be fully aware of the disclosure requirements and recommendations in the Stock Exchange of Hong Kong Limited (the “Exchange”).

Here is a link to the Corporate Governance Guide for Boards and Directors (May 2025).

“Corporate Governance covers many topics, all of which play an important role in ensuring that an issuer is effectively managed with an appropriate system of risk management and internal controls supporting regulatory compliance, good business practices and sustainability.

Board Effectiveness.

An effective board is key to an issuer’s long-term success. The board’s ability to work effectively may be influenced by different factors, including: (i) whether the board leads by example and shapes the desired culture to support the company’s purpose, values and strategy; (ii) whether the board maintains the right mix of skills and qualifications for the pursuit of issuer’s strategic objectives; and (iii) whether the board actively engages with stakeholders to ensure constructive feedback is considered in the board’s decision-making.“

Diversity.

Diversity is an important driver of board effectiveness and quality decision-making. A high-performance board should have an appropriate balance of skills, experience and diversity of perspectives. Issuers are encouraged to adopt an inclusive mindset and consider different aspects of diversity - including but not limited to gender, age, cultural and educational background, and professional experience.

Gender diversity on the board

Issuers are required to have at least one director of a different gender on the board. An issuer who fails to comply with this requirement (for example, where the sole director of a different gender resigns) must immediately publish an announcement containing the relevant details and reasons. That issuer must then appoint appropriate member(s) to the board to re-comply with such requirement within three months after failing to meet it.

Issuers should continue to assess their own circumstances and needs; and strive to commit to gender diversity targets beyond the required minimum of one.

2. Hong Kong’s leading role in advancing gender leadership opportunities in financial services, October 2025

A joint report by the Women Chief Executives Hong Kong (“WCE HK”), KPMG, and The Women’s Foundation (“TWF”) has found that a set of six societal factors – collectively termed “VOICES” – is underpinning Hong Kong’s success in advancing women’s leadership across the financial services industry.

The report, titled “Tipping the Scale – Hong Kong’s Leading Role in Advancing Gender Leadership Opportunities in Financial Services”, shows that women now hold 45% of senior leadership1 positions and 37% of board director positions in Hong Kong’s financial sector, representing double-digit increases since 20182.

Based on a survey of over 530 financial services professionals, the report attributes these gains in part to a combination of regulatory, societal, and organizational advances, underpinned by the VOICES framework:

• Visible acceptance to break the glass ceiling

• Open family support systems

• Infrastructure for work-life agility

• Culture of entrepreneurship, merit and adaptability

• Education that’s equitable, and

• Safety that fosters confidence.

3. Community Business annual report: “Women on Boards Hong Kong” up to 2019

Published annually on Women's day in March, the “Women on Boards Hong Kong” report which focuses on Hang Seng Index companies, and provides many figures about the composition of HSI boards. Hong Kong has lagged behind other major financial centers, and in Asia, Singapore and India are catching up and at current rates of improvement will soon surpass Hong Kong. This report is the ninth study of its kind and serves as a credible and authoritative resource to report on the status quo of the gender diversity of Hong Kong's boardrooms today and also to identify trends and track performance over time.

diversity resources

1. Mckinsey & Co. - a series investigating the business case for diversity

Diversity matters even more: The case for holistic impact - Mckinsey & Co. (Dec 2023)

Diversity Matters Even More is the fourth report in a McKinsey series investigating the business case for diversity, following Why Diversity Matters (2015), Delivering Through Diversity (2018), and Diversity Wins (2020). For almost a decade through our Diversity Matters series of reports, McKinsey has delivered a comprehensive global perspective on the relationship between leadership diversity and company performance. This year, the business case is the strongest it has been since we’ve been tracking and, for the first time in some areas, equitable representation is in sight. Further, a striking new finding is that leadership diversity is also convincingly associated with holistic growth ambitions, greater social impact, and more satisfied workforces.

Diversity wins: How inclusion matters - Mckinsey & Co. (May 2020)

The report shows not only that the business case remains robust but also that the relationship between diversity on executive teams and the likelihood of financial outperformance has strengthened over time. These findings emerge from our largest data set so far, encompassing 15 countries and more than 1,000 large companies. By incorporating a “social listening” analysis of employee sentiment in online reviews, the report also provides new insights into how inclusion matters. It shows that companies should pay much greater attention to inclusion, even when they are relatively diverse.

Delivering through Diversity - Mckinsey & Co. (Jan 2018)

Delivering through Diversity both tackles the business case and provides a perspective on how to take action on I&D to impact growth and business performance. This research reaffirms the global relevance of the correlation between diversity (defined here as a greater proportion of women and ethnically/culturally diverse individuals) in the leadership of large companies and financial out-performance. The research is based on a larger data set of over 1,000 companies covering 12 countries and using two measures of financial performance – profitability (measured as average EBIT margin) and value creation (measured as economic profit margin). As importantly, Mckinsey & Co. studied the I&D efforts of 17 companies representing all major regions and multiple industries to have a more granular view of where in the organization diversity matters most, and crucially, how leading companies have successfully harnessed the potential of I&D to help meet their growth objectives.

Female representation in corporate boardrooms continues to increase, but we found a different picture when looking at corporate leadership positions. According to Women on Boards and Beyond 2024, women occupy 27.3% of board seats at large- and mid-cap companies, constituents of the MSCI ACWI Index (as of October 2024) — a 1.5 percentage point increase from 2023. However, the report shows that men still largely occupy top executive roles, with female representation declining among these positions.

For 15 years, we have analyzed women's representation on corporate boards through our annual reports. This year we have broadened our focus to include women’s involvement on key board committees, examining the specific roles they play and the factors that may impact their board tenure.

Key insights:

Fewer leadership roles: Female representation in certain leadership roles declined, particularly in emerging markets where the percentage of female board chairs, CEOs and CFOs all fell below 2023 levels.

Committee gaps: While all-male boards were nearly non-existent in developed markets, 10.6% of nomination committees, 13.1% of pay committees and 8.1% of audit committees lacked female members in those markets.

Nominating role: Nomination committees, crucial for shaping board composition, were the least likely to be chaired by women across all markets reviewed. Further, boards with female nomination committee chairs tended to have more female directors overall.

Retention challenges: Board continuity among male directors was higher than for their female counterparts across all markets in our analysis.

Financial performance: MSCI ACWI Index constituents with at least 30% female directors achieved cumulative returns that were 18.9% higher than those without, between July 31, 2019, and Sept. 30, 2024.1

Race and ethnicity: Ethnic minority representation in corporate leadership positions remained limited based on our analysis of U.K. and U.S. firms.

The interactive chart below provides a visual overview of female representation on boards of directors and board committees across developed and emerging markets, as of October 2024.

3. PwC Annual Corporates Directors Survey - 2025

“For nearly two decades, PwC’s Annual Corporate Directors Survey has provided critical insights into the evolving dynamics within US boardrooms. Over this period, we’ve charted the shifting priorities, expectations and pressures facing directors. Our 2025 survey reveals an unprecedented inflection point that underscores a profound and pressing need for greater accountability within boards.

Directors increasingly recognize that their effectiveness — and, by extension, their ability to provide effective oversight — hinges significantly on confronting underperformance head-on. To that end, directors must embrace candid self-assessment, challenge complacency and proactively refresh their boards to help align with strategic goals, stakeholder expectations and rapidly evolving market dynamics.

This year, our report not only highlights areas where boards tell us they are falling short but provides practical pathways for directors and executives committed to change. It is our hope that this report serves as a roadmap, enabling boards to take decisive action toward driving sustained corporate success.”

In the 2025 report, the question whether board diversity is at a crossroads is asked. “Following year-over-year increases in gender, race and ethnic representation on boards, there are early signs that we may see a slowdown. This year, the percentage of directors who say their boards are planning to add gender diversity dropped to 9% from 21% in 2024, and plans to add racial or ethnic diversity fell to just 6% from 13% in 2024.”

4. Egon Zehnder 2024-2025 The Progress of Board Diversity

For 20 years, Egon Zehnder has tracked board diversity around the globe, witnessing many milestones, steps forward, and setbacks. The path to progress has been uneven at times but incremental gains have been constant. Over the span of 12 years, from 2012 to 2024, the percentage of board positions held by women globally has risen steadily from 13.6 % to 29.3%, with an average increment of 2.6% change every two years.

We have also seen external social forces influence the pace of change. For example, 2017’s #MeToo movement and 2020’s racial equity protests both prompted global surges in corporate DEI commitments that often led to representational increases in the following years:

Globally the number of companies that have a woman on the board rose from 84.9% in 2018 to 96% in 2024.

In 2020, black directors comprised about 5% of directorships of Russell 3000 companies, and in 2022 that number rose to 8.1%.

5. Missing Pieces Report, Deloitte (Jun 2023)

A board diversity census of women and underrepresented racial and ethnic groups on Fortune 500 boards, 7th edition

The importance of diversity on the board of directors

The Missing Pieces report is a multiyear study organized by the Alliance for Board Diversity (ABD) in collaboration with Deloitte for the 2016, 2018, 2020, and 2022 censuses. The report highlights the progress to date that has, or has not, been made in the equitable representation of women and individuals from underrepresented racial and ethnic groups (UR&EG) on Fortune 500 boards.

6. EY resources

Four key actions to accelerate board diversity

How fund boards can drive diversity, equity and inclusion in investment management

7. Credit Suisse: The CS Gender 3000

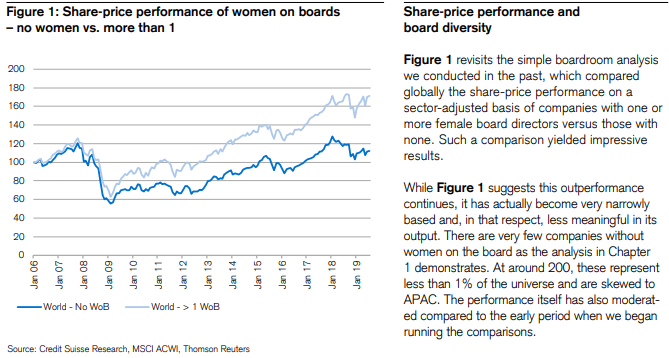

A key message from Credit Suisse 2019 study “The Credit Suisse Gender 3000: Women in Senior Management” is that gender diversity in the boardroom worldwide has doubled during the decade to over 20%. An interesting conclusion in light of Hong Kong’s challenges is that countries with a lower female representation in senior management and on boards were found to have a wider gender pay gap.

The research concludes that diversity coincided with superior share-price performance, and higher “quality” factor when assessing the corporate-performance characteristics.

8. Bank of America Merrill Lynch “ESG from A to Z: a global primer”

Board diversity signals better ROE… While performance results have varied over time, BAML found that companies with better scores on board diversity and management diversity saw consistently higher future ROEs than counterparts with lower scores. Companies with more diverse boards (score >50) had higher subsequent 1-year ROEs than companies with less diverse boards (score <50) every year since 2005. Board Diversity was an effective signal of future ROE in almost all sectors, except for Financials. Discretionary and Tech companies have historically been rewarded the most.

Gender diversity = lower earnings risk On all three sub-pillar scores BAML analysed from Refinitiv (board diversity, company policies on diversity/inclusion, and women in management), companies with high ESG scores had lower earnings volatility than companies with low ESG scores on these metrics. Companies with >50 scores on board diversity have also seen consistently lower EPS volatility than companies with <50 scores, every year since 2005.

Consistent premium for board diversity Excluding Financials, companies with 50 or higher scores on Board Diversity have traded at a (growing) premium on Price to Book, relative to companies with scores below 50 on Board Diversity.

To include your research in the Reference Shelf, please email info@boarddiversityhk.org.

9. UK FRC report: “Board diversity and Effectiveness in FTSE350 companies", July 2021

UK FRC published the "Board diversity and Effectiveness in FTSE350 companies" report in July, regarding the relationship between boardroom diversity and financial performance of FTSE350 companies, showing a positive correlation between boardroom gender diversity and improved financial performance metrics such as EBITDA margin after a 3-5 year time lag. A deeper-dive review indicated for FTSE250 companies the effects were larger especially in Year 5 and beyond and supports the Hampton-Alexander Review’s U-Shaped theory. We highlight that report as a lot of the available research take a more short-term time frame (1-2 years). In addition, some of the other links related to positive attributes to mid to long-term growth of corporate value were also intriguing.